Do the names Jeff White, Suleyka Bolaños, or Ila Corcoran ring a bell to you? Let’s take a look at their stories. Jeff White and Suleyka Bolaños started investing by purchasing one rental property annually, making use of low down payments. By 2023, the pair were able to retire early as the rental income had surpassed their salaries.

This story is similar to Ila Corcoran, who bought her first home at 22 years old, using a Federal Housing Administration (FHA) loan. She rented out rooms to cover her mortgage payments. Four years later, she purchased an additional property. Both examples show how affordable investing can be built, leading to long-term wealth. These examples highlight the potential of cheap real estate investments to generate substantial profits.

While cheap is a relatively subjective term, when it comes to “cheap” in real estate, we refer to acquiring a property at a lower purchase price. Investors make use of emerging markets or undervalued properties, allowing them to enter the real estate market with minimal capital.

Investing in these affordable properties, investors can build a steady income stream and property appreciation over time. The investor will need to be strategic, planning and monitoring markets to find an ideal cheap real estate investment, which matches their goals.

You can start investing now from the Gamma Asset Investment Platform

The Benefits of Investing in Cheap Real Estate

The first glaring benefit of cheap real estate is the lower upfront capital. Investors are beginning to look at emerging markets and undervalued properties where the entry point remains low.

Rising interest rates or periods of uncertainty in the real estate market can cause investors to strain. Affordable real estate offers far less risk for investors. All cash payments or lower monthly mortgages are both great at mitigating additional risk. This is a great option for new, cautious, or portfolio-building investors. Leveraging cheap real estate investments allows for spreading risk across multiple properties.

The lower costs mean investors can spread investments out over several properties rather than investing in one high-cost property. This will reduce investors’ risks through portfolio diversification.

Investors can increase the value of their investment by renovating. This can be through a property “flip” or for a rental property, increasing rental income. Properties with newly renovated kitchens and bathrooms yield the highest returns. Renting out a renovated property will provide a consistent income when located in growing areas. As rental demand increases, so will the rental return.

Property values will increase when growing areas improve in infrastructure, and the population grows, as this will increase demand. It is well known that value increases with scarcity and demand. When this occurs, these areas will experience a spike in value.

These cheap real estate investments are wonderful for building wealth; they require a little more research and due diligence, but these hidden jewels are worth the work.

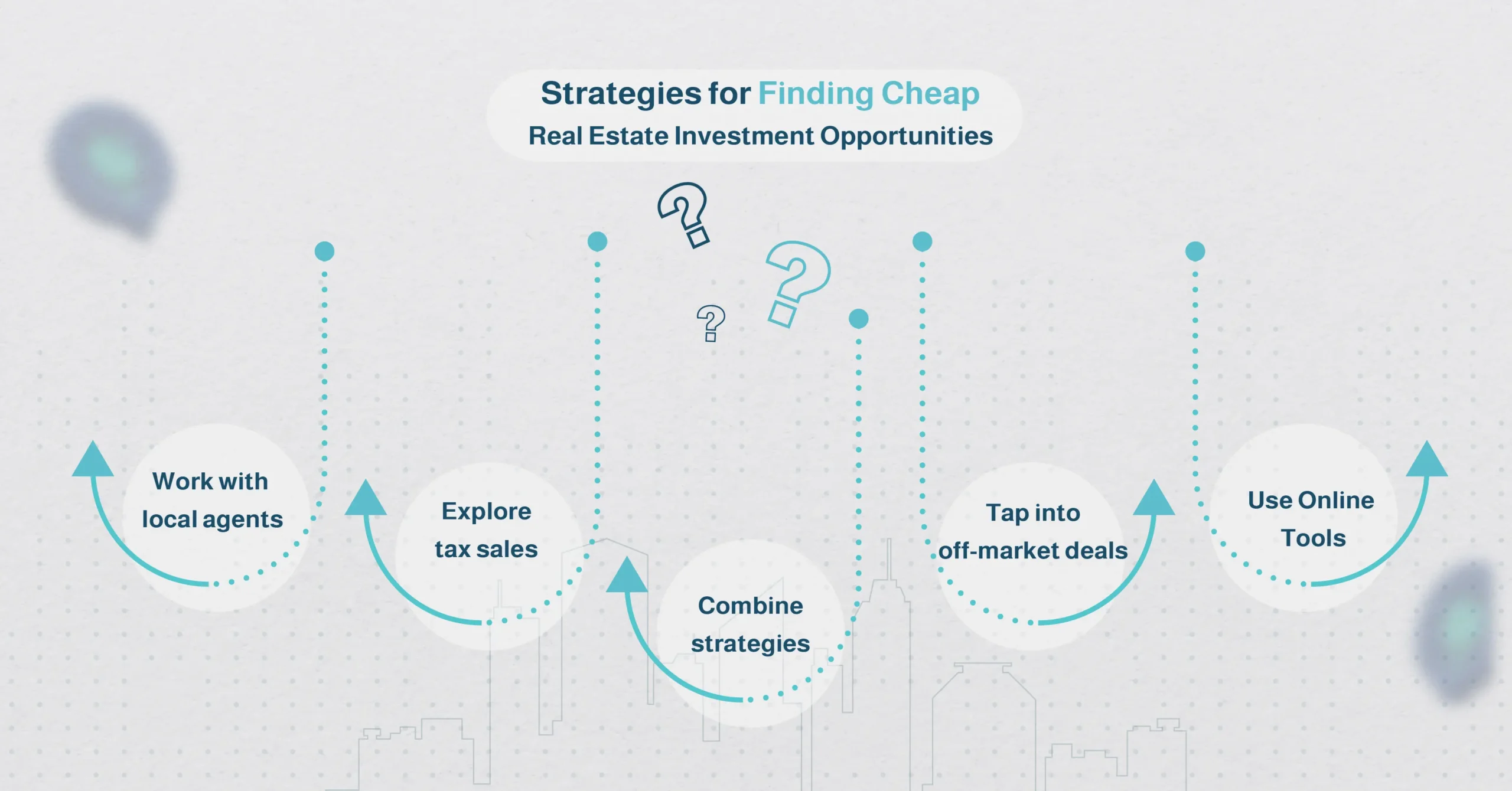

Strategies for Finding Cheap Real Estate Investment Opportunities

Finding the perfect cheap real estate investment does not need to be like trying to find a needle in a haystack, although it does require time, research, and vision. In 2025, we have a multitude of tools and strategies at our disposal, allowing us to uncover high-potential affordable properties. Utilize digital tools to identify promising cheap real estate investments.

Use Online Tools and Auction Platforms

Search properties by price on web marketplaces such as Zillow, Realtor.com, or the equivalent in the country you are interested in. This filter will help you find undervalued properties quickly. Auctions, either in person or online, can offer a good deal (auction.com or Bid4assets) due to foreclosures or bank-owned properties. The option to bid remotely gives access to this opportunity.

Tap into off-market deals and Wholesale

Working with wholesalers- they act as finders, charging a small fee to locate distressed or motivated sellers, driving through the area, social media groups, and even the old-fashioned mail campaigns, are often home to the best bargains.

Explore tax sales

When the taxes of the property owner are in arrears, the property may be seized as payment. The property may be auctioned at a reduced rate; in some cases, the winning bid will earn interest or the ownership of the property. There are websites that these properties are listed on, they offer unique options for cheap real estate investments.

Work with local agents and scout undervalued areas

Working closely with real estate agents can provide valuable insights into emerging markets, underpriced listings. Areas of interest with new infrastructure or increased demand.

Combine strategies for better results

For those looking for cheap real estate investment opportunities, combining online tools with local knowledge, agent connections, and alternative channels like tax sales. This combination will inevitably lead to success.

Top Cities for Affordable Real Estate Investment Opportunities

To find attractive budget-friendly real estate investments, we need to look at cities showing affordability, strong demand for rentals, and promising growth opportunities.

Co Medellín, Colombia

The “City of the Eternal Spring”, offers a beautiful climate, wonderful culture, a bustling tech and tourism hub, and a compelling investment opportunity. Costing around $145 per square foot, a 1000 square foot apartment will only cost $ 145000, a decent investment.

Kraków, Poland

With a strong economy, a flourishing tech industry, and historical charm, Kraków is quickly becoming a city to watch. EU-funded infrastructure projects and investor- friendly policies Kraków is very appealing for long-term growth.

Ho Chi Minh, Vietnam

The government has committed to investing in infrastructure and favourable foreign investment policies to create opportunities for investors. Investors should take advantage of the rapid urbanization and growing middle class in both commercial and residential investments.

Lisbon, Portugal

The Golden Visa program, modern amenities, and history in spades. Lisbon is fast becoming an investment powerhouse with infrastructure improvements and a growing tech sector. Property value appreciation and rental income are advantageous to investors.

Indianapolis, Indiana, USA

Rental demand is high as several universities are nearby. The job market is strong, and there are affordable housing options. This US city is family-oriented and has a growing population.

These cities offer cheap or affordable real estate investment options, combining affordability with growth opportunities. As an investor, it is important to keep an ear to the ground and search for favourable economic indicators that can maximize returns.

Risks and Rewards of Investing in Low-Cost Real Estate

Low price does not mean no risk; the reason for the lower purchase price might be due to a stagnant or declining economy, or declining neighborhoods. In such cases, the property value is at risk of decreasing. The investor needs to ensure that there are not going to be very high maintenance costs associated with the property, and have a plan in case the lower income of the renters means a lack of rental income. These factors could affect your profit margins.

Preventing these risks means conducting thorough due diligence before you purchase the property. We would advise getting a home inspection, looking into the market trends of the area, and ensuring you have a savings pocket for unexpected expenses. Finding reliable contractors and property managers will be an asset in the future, too.

Even with the aforementioned risks, cheap real estate investments can be very appealing. Many experienced investors will use these properties as stepping stones in wealth building. Investing in these properties in developing neighborhoods will yield higher rental percentages, allowing room for equity growth.

In the short term, these types of properties can be a risky investment, but with careful consideration and planning, these cheap real estate investments can be highly profitable long term.

How to Maximize Profits with Cheap Real Estate Investments

Renovation strategies for Value-add properties

The adage of “you have to spend money to make money” feels appropriate here. Cost-efficient renovations to areas with high returns are a good way of going about this. Kitchen and bathroom upgrades yield the highest return, but a coat of paint and updating the facade or front of the property to add “curb appeal” will do wonders for your property value. Consider this to be like the velvet service you give your vehicle before selling or trading it in.

Creative Financing Options

There are many options for financing your dream investment these days. We will take a closer look at these.

- Seller financing: This means an arrangement between the seller and the investor, where you pay them directly for the property. Often meaning a lower cost up-front.

- Partnerships: investing in a property with a partner can be a good method as you are able to pool resources.

- Real Estate Investment Trusts (REITs): This method means you will be involved in investing in a portfolio of properties rather than one individual property. This comes with less risk and direct ownership responsibilities.

Rental Income Strategies

- House Hacking: This is the creative method Ila Corcoran used when buying her first property. It involves you renting out parts or sections of your property while you live in the other section. It helps eliminate your housing cost. This can can be done on a room by room basis too.

- Short-term rentals: Platforms like Airbnb have been a wonderful tool for countless investors. The platform allows higher per-night rates especially in high-demand areas or during peak holiday season.

Leveraging Automation and Property Management

Get rid of the day-to-day property management through the use of property management software, which will help you, as an investor, streamline processes, collect rent, and organize maintenance schedules. Platforms such as Gamma assets provide real-time analytics and market insights, helping investors stay informed.

If you just simply lack the hours in a day, you could make use of a professional. Property managers are a perfect solution, especially if you own multiple properties. This solution will mean an additional cost, but will help tenant relations and improve lease longevity.

Using all the tools in your investment arsenal will help you unlock the potential of cheap real estate investments.

More topics can be read on the Gamma blog

FAQ About Cheap Real Estate Investments

Cheap real estate investments are a great option for first-time or budget-friendly investors

Can I invest $500 in real estate?

Yes, using platforms like Fundrise, you can invest in diversified portfolios with $10. The Gamma Assets Platform allows investors to get involved with group fractionalized property investments for as little as $130. Crowdfunding is great way to begin your investment journey.

What is the lowest amount to invest in real estate?

It varies for the different sites. Some platforms accept from as little as $10 to $500. REITs and real estate crowdfunding are the easiest way to gain access to investments with little capital.

What is the cheapest form of real estate?

Foreclosures, vacant land, Mobile homes, and bank-owned properties are usually the most affordable. They are higher risk but can yield strong returns with a little work.

Where is the cheapest real estate?

The best prices can usually be found in rural areas or in emerging markets. In the US, parts of the Midwest and South offer affordable options. Eastern European and South Asian markets can be the source of good investment opportunities.

The first step to building long-term wealth can be through the purchase of a cheap real estate investment. We have seen it be done countless times before. It can be a gratifying experience and offer great opportunities. Why not start your investment journey today?