Digital investing has grown rapidly over the past decade, opening up new ways to access markets that were once difficult or expensive to enter. Alongside this growth, investors have also become more cautious, asking important questions about value, risk, and long-term sustainability. This is where asset backed digital investments have gained attention.

Unlike purely speculative digital assets, asset backed digital investments are linked to tangible or income-generating assets. This connection provides structure, transparency, and a clearer basis for valuation. For investors navigating an increasingly digital financial landscape, understanding how asset backing works is essential.

This article explains asset backed digital investments in practical terms, explores how asset backing influences risk and value, and looks closely at property as one of the most established backing assets in the digital investment space.

More topics can be read on the Gamma blog

Asset Backed Digital Investments Explained

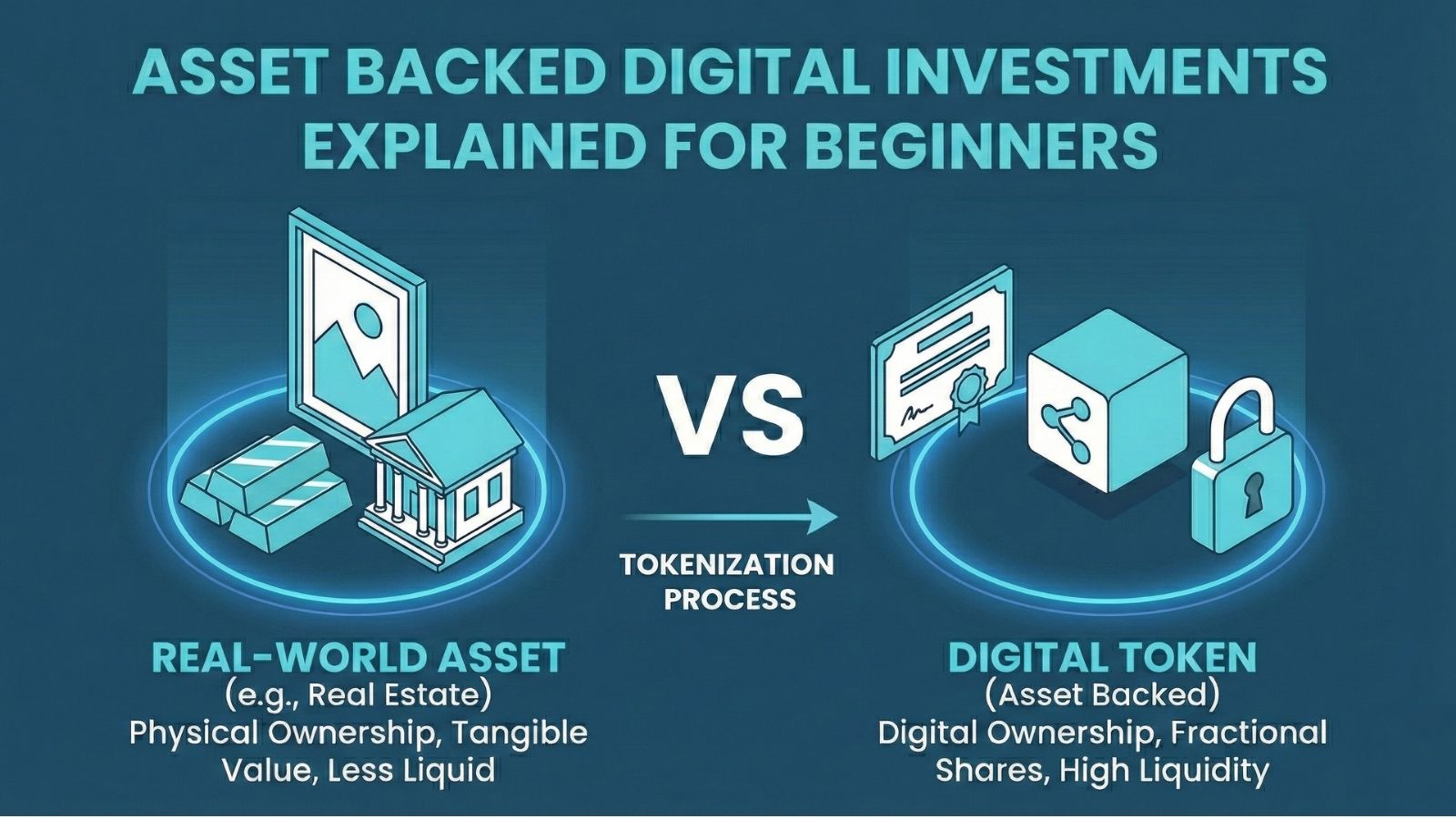

At their core, asset backed digital investments are digital financial instruments that gain their value from real-world assets. These assets can include property, commodities, infrastructure, or other tangible resources that exist independently of market confidence.

The key distinction lies in backing. The digital investment itself may be represented by tokens, shares, or digital units, but its value is anchored to an underlying asset. This means that ownership, income, or value is not purely theoretical or speculative.

In contrast to digital assets that rely solely on demand and perception, asset backed digital investments introduce a measurable reference point. The asset exists regardless of market conditions, and its performance influences the digital investment tied to it.

This structure appeals to investors seeking exposure to digital platforms while retaining a connection to real-world value. As digital finance evolves, asset backed digital investments offer a middle ground between innovation and stability.

How Asset Backing Impacts Risk and Value

A tangible asset that supports an investment will lead to risk behaving differently. While asset backing does not eliminate risk entirely, it does change its nature.

In asset backed digital investments, value is influenced by the performance and condition of the underlying asset. For example, property-backed investments are affected by rental demand, location, and maintenance rather than short-term market sentiment alone. This tends to moderate price volatility and reduce sudden valuation swings.

Asset backing also improves valuation clarity. Investors can assess the underlying asset using familiar metrics such as income potential, replacement cost, and historical performance. This makes it easier to evaluate whether pricing is reasonable or disconnected from fundamentals.

Another important factor is how asset backing affects investor behaviour. When value is tied to something tangible, decision-making tends to be more measured. Investors are less likely to react impulsively to short-term price movements and more likely to focus on long-term performance. Without asset backing, digital investments can be heavily influenced by speculation, trends, and momentum, which increases emotional decision-making and volatility.

For investors focused on long-term planning, this connection between asset performance and digital value is a critical differentiator within asset backed digital investments.

Another important way asset backing influences risk is through how investors interpret change. When value is tied to a real asset, fluctuations are often easier to contextualize. A change in value can usually be linked back to something concrete, such as shifts in demand, operating costs, or broader economic conditions. This gives investors clearer signals about whether a change is temporary or structural, making risk easier to assess over time.

Asset backing also affects the pace at which value changes. Assets like property tend to adjust gradually, allowing investors time to evaluate performance and respond thoughtfully. In contrast, digital investments without backing can experience rapid revaluations driven by confidence, expectations, or short-term behaviour. This difference in speed plays a significant role in overall risk exposure and is a key reason many investors are drawn to asset backed digital investments for long-term planning.

Property as an Asset Backed Digital Investment

Property is one of the most established and widely understood assets used to support digital investments. Its long history as a store of value makes it a natural fit for asset backed digital investments.

When property is used as the backing asset, digital investors gain exposure to real estate without owning buildings directly. Value is supported by physical assets that can generate rental income and appreciate over time. This creates two layers of support: income generation and intrinsic asset value.

Property-backed digital investments also benefit from familiarity; investors trust what they know. Investors understand how property markets work, how value is created, and what risks exist. This makes it easier to assess performance compared to newer or less tangible asset classes.

Another advantage lies in resilience. Property tends to perform more steadily across economic cycles, particularly when compared to assets driven by sentiment. While property values can fluctuate, demand for housing and commercial space tends to persist over time. This stability strengthens the role of property within asset backed digital investments, especially for investors seeking predictable income and long-term value preservation.

Property also lends itself well to digital investment structures because it can be divided without changing its underlying function. Fractional ownership allows multiple investors to participate in the same asset while the property continues to operate as a single, income-generating unit. This makes property particularly suitable for digital models, as value can be distributed proportionally without affecting day-to-day management or performance.

Accessibility is another important factor. Digital structures reduce traditional barriers such as large capital requirements, complex transactions, and geographic limitations. Investors can gain exposure to property-backed opportunities with smaller commitments, while still benefiting from asset backing and income potential. This combination of familiarity, scalability, and stability helps explain why property plays such a central role in the asset backed digital investments landscape.

Asset Backed vs Non-Backed Digital Assets

To fully understand the appeal of asset backed digital investments, it helps to compare them directly with non-backed digital assets.

Non-backed digital assets derive their value primarily from market demand, adoption, or perceived future utility. While they can deliver rapid gains, they are also exposed to sharp declines when sentiment shifts.

Asset backed digital investments behave differently because their value is linked to underlying assets with independent worth. The table below highlights the key differences.

| Feature | Asset Backed Digital Investments | Non-Backed Digital Assets |

| Source of Value | Tangible or income-generating assets | Market sentiment and speculation |

| Volatility | Generally lower | Often high and unpredictable |

| Valuation basis | Asset performance and fundamentals | Demand, trends, and perception |

| Income generation | Often supported by asset income | Typically none |

| Downside protection | Partial, through asset value | Limited or none |

| Transparency | Asset-level data and disclosures | Market-driven pricing only |

| Long-term planning | Easier to model and forecast | Difficult to predict outcomes |

This comparison highlights why asset backed digital investments appeal to investors who prioritize structure, transparency, and resilience over rapid speculation.

Asset Backed Digital Investments on Gamma Assets

Gamma Assets focuses on making property-based digital investing accessible while maintaining clear asset backing and structured compliance.

Through Gamma Assets, investors gain exposure to real estate assets via digital investment structures that are directly linked to underlying properties. Ownership interests, income distribution, and asset information are clearly defined, allowing investors to understand exactly what supports their investment.

By anchoring digital investments to real-world property, Gamma Assets addresses many of the concerns associated with non-backed digital assets. The result is an approach that combines digital efficiency with tangible value, making asset backed digital investments more accessible without increasing unnecessary risk.

In addition, property-backed digital models can align more closely with Shariah-compliant investment principles when structured appropriately. Because these investments are linked to tangible assets and income generated from real economic activity, they avoid many of the concerns associated with interest-based or purely speculative instruments. For investors seeking ethical or faith-aligned options, asset backed digital investments offer a framework that can support transparency, asset ownership, and risk-sharing. While compliance depends on specific structuring and oversight, property-backed models provide a clearer foundation for Shariah-aligned investing than non-backed digital assets driven solely by price speculation.

You can start investing now from the Gamma Asset Investment Platform

Asset backed digital investments offer a structured way to participate in digital finance without disconnecting from real-world value. By linking digital instruments to tangible assets, they introduce clarity, transparency, and a more measured risk profile.

As digital investing continues to evolve, asset backing provides an important reference point. It allows investors to evaluate opportunities based on fundamentals rather than hype. For those seeking balance between innovation and stability, asset backed digital investments represent a thoughtful and increasingly relevant option.

Frequently Asked Questions

What assets can back digital investments?

A wide range of assets can back digital investments, provided they can be legally structured and reliably valued. Common examples include property, commodities, infrastructure projects, and revenue-generating businesses.

Assets with predictable income, established markets, and clear ownership structures tend to provide stronger backing. Property remains one of the most widely used options due to its durability, income potential, and long-term demand.

Are asset backed investments safer?

Asset backed digital investments are generally considered safer than non-backed digital assets, but safety is relative rather than absolute. Asset backing reduces exposure to pure speculation by anchoring value to something tangible, which can help limit volatility.

However, asset performance, management quality, and market conditions still matter. Asset backing improves transparency and risk assessment, rather than removing risk entirely.

How is value maintained?

Value in asset backed digital investments is maintained through the performance and ongoing relevance of the underlying asset. Income generation, demand, and long-term utility all contribute to value retention.

In property-backed models, rental income and continued demand for space help support pricing over time. Even during slower market periods, the asset continues to serve a purpose, which plays a central role in maintaining value.