While we know that investing in real estate is a great way to build long-term wealth, passive income, and ensure financial stability, not every property will be the pay day we expect. Smart investors must understand how to calculate ROI on real estate investments. For success in real estate, understanding precisely how to calculate ROI on real estate investments is key to maximizing returns

Whether you intend on flipping the property or renting units out, understanding how profitable a property is is paramount to success. Return on Investment (ROI) is a metric that shows you how profitable your property will be when compared the the money you put into the investment. As a foundational skill, knowing how to calculate ROI on real estate investments positions you for success. By calculating the ROI before you purchase the property, you can avoid overpaying and manage your risk. In our guide, we will be covering the following topics:

- What does ROI mean in real estate

- Key factors that influence it

- How to calculate it, step-by-step

- Ways to improve

- Common mistakes to avoid

You can start investing now from the Gamma Asset Investment Platform

Understanding the Basics – How to Calculate ROI on Real Estate Investment

We use ROI (Return on Investment) to measure how much profit you make in relation to total investment, which is represented as a percentage.

The Basic Formula

ROI = (Net profit/ Total investment) x 100

Net profit is the total rental income less any expenses (tax or maintenance)

Total Investment is the purchase price + closing costs + renovation costs + any fees

Shall we have a look at an example of a property to be purchased in cash?

Purchase Price $200,000

Renovations $20,000

Annual Rental Income $24,000

Annual Expenses $6,000

Net Profit =$24,000 – $6,000 = $18,000

Total investment =$200,000 + $20,000 +$220,000

RIO = ($18,000 /$220,000) x 100= 8.18%

Investors aim for an ROI matching or exceeding the average return of the stock market, usually around 10%. 5-10% ROI on a rental is considered a good point.

Now, what if we had financed the purchase?

Down payment $50,000

Loan $ 150,000

Same rental income and expenses

ROI = ($18,000 / $50,000)x100 = 36% Cash-on-cash ROI

When using leverage (financing), your cash-on-cash ROI increases, 8-12% is considered good range depending on the market.

The differences between the two for the same property show which method of financing is best for you and your goals.

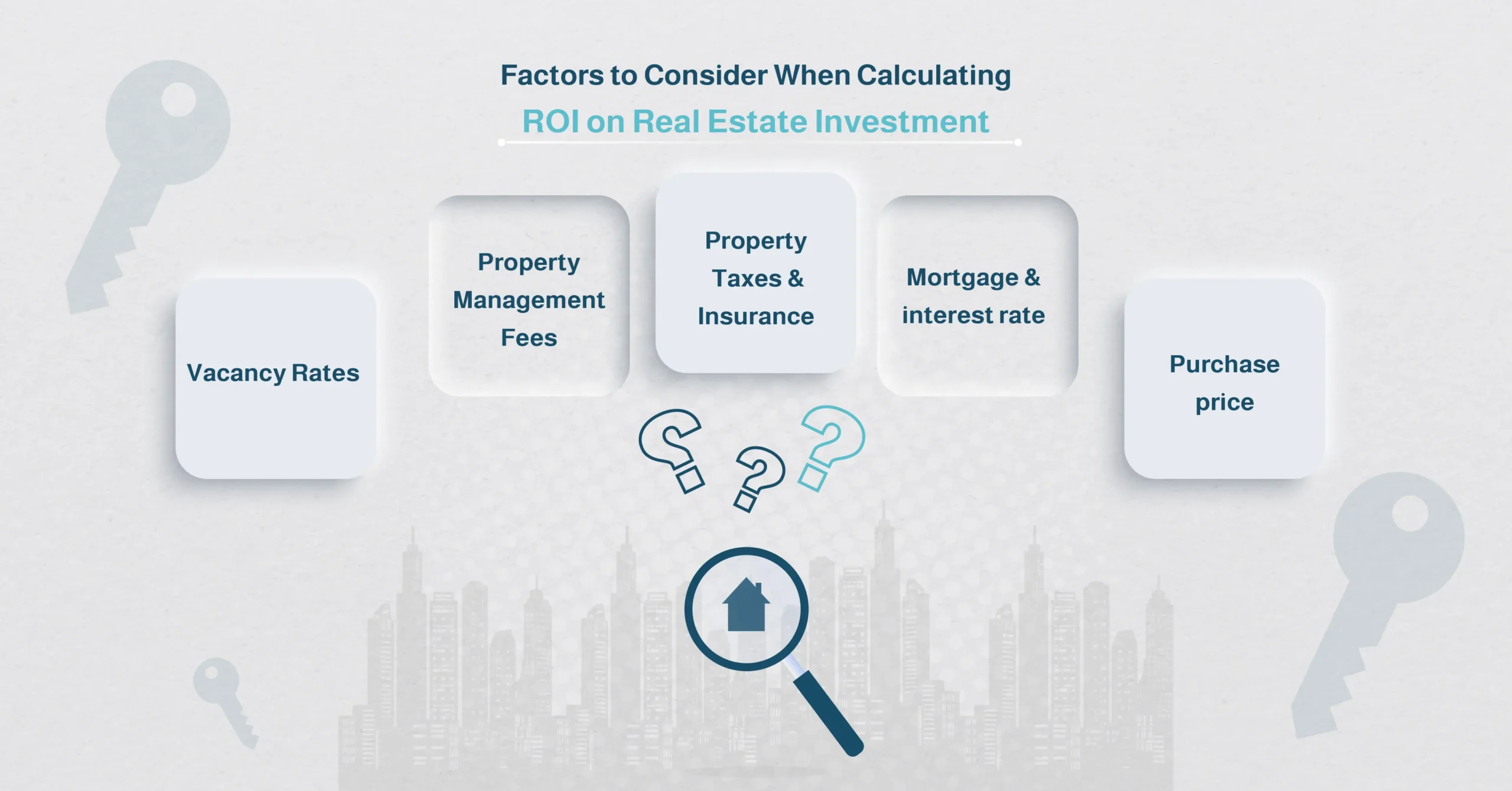

Factors to Consider When Calculating ROI on Real Estate Investment

Several factors must be considered when calculating ROI on real estate investments, such as purchase price, taxes, and maintenance.

- Purchase price: It is important to ensure you do not overspend here; even a good rental income may not help if you have.

- Mortgage and interest rates: Financing may impact your ROI and monthly payment with interest rates and loan terms.

- Property Taxes and Insurance: It is important to take note of local rates as they vary dramatically between locations.

- Maintenance and Repairs: Repairs can be expensive, and the costs directly reduce your net income. It is important first to have the property inspected and secondly to set aside a budget for such events (1-2% of the property value annually)

- Property Management Fees: While hiring a property manager makes sense, it can also eat into your monthly rent; you can expect to pay 8-12% of the monthly rent for such a service. This will impact your ROI on real estate investment figures.

- Vacancy Rates: It is wise to estimate a 5-10% vacancy rate for investment properties. There will be periods of vacancy, meaning no rental income.

- Appreciation and Depreciation: Appreciation or depreciation can affect the ROI, which generally focuses on annual rental returns.

- Rental Income vs. Expenses: Your ROI will be higher if there is a bigger gap between money going out and money coming in.

Understanding these variables is important in correctly calculating a realistic and actionable real estate investment ROI, not just a pipe dream figure.

Analyzing the Return: A Step-by-Step Guide to Calculating ROI on Real Estate

Analyzing ROI involves understanding how to calculate ROI on real estate investments, a crucial investment step. Time for a math lesson, we will take a look at how to calculate ROI on real estate investments using real examples. You purchase a property for $300,000 using finance. You put down 20% as the down payment, $60,000, therefore, the loan amount is $240,000 with an interest rate of 6%. Annual rental income is $30,000, with operating expenses (insurance, maintenance, taxes, etc.)of $8,000, finally annual mortgage payments of $17,000.

Let’s look at the ROI equation step-by-step:

Step 1: Calculate the net profit (Cash flow)

Rental income- expenses = net income

$30,000 – $8,000 – $17,000 = $5,000 net income

Step 2: (Determine the total Investment)

You put in $60,000 as your down payment, so your cash investment is $60,000.

$60,000 cash investment

Step 3: Apply the ROI formula

ROI (cash-on-cash) = (Net profit/ total investment) x 100

ROI = ($5,000 / $60,000) x 100

Cash-on-cash ROI = 8.3%

We can take this a step further and work out the total ROI with appreciation.

Let’s assume that the property appreciated by 3% annually, so $9,000

Net gain = $5,000 cash flow + $9,000 appreciation = $14,000

ROI = ($14,000/ $60,000) x 100 = 23,3%

Calculating ROI on real estate investments is fairly straightforward, and some sites and apps, like Gamma Assets, a dynamic real estate analysis tool, will do this for you in seconds, but it is worth your time to understand the key factors that make up ROI. You should always compare cash-on-cash ROI with total ROI. Cash-on-cash ROI focuses on the immediate cash flow generated by an investment, whereas total ROI takes into account the appreciation or depreciation and is the total return over the full holding period.

Maximizing Your Investment – Strategies for Improving ROI in Real Estate

You don’t need to buy more properties to improve your ROI, it rather refers to making your current investment more financially successful and “work for you”. We will look at tried and true methods of improving ROI on real estate investment.

Renovations & Value-Adding Upgrades

Spending little money on the property will help increase rental value and property appreciation. Kitchen and bathrooms are the best value boosters, but adding amenities and energy-efficient options makes the property more attractive to renters.

Increase Rent Strategically

Annual review of the rent, along with the adjustment to match the market rates. Even an increase of $50 per month can make a huge difference to your ROI.

Reduce Operating Costs

Spend a little time looking for the most cost-effective insurance, automate systems to reduce utility bills, and ensure that property management fees are negotiated to suit your needs.

Location Matters

The area you are investing in must be a neighborhood with high demand and a growing population. This will mean good rental income and higher rental prices.

Employing these quick and manageable steps will mean measurable gains and good long-term returns on your investment.

The Importance of ROI in Real Estate Investing – Tips for Success

Understanding how to calculate ROI on real estate investments allows you to make smart and well-informed investment decisions. We will take a look at the reasons why ROI is important in real estate investment.

- Helps You Evaluate Deals: ROI allows you to spot the best investment opportunities and find the high-performing properties.

- Data-Driven Choices: Knowing what the returns are for a property will help you choose investments for their merit rather than due to a trend.

- Avoids Financial Traps: You will be able to avoid properties that are over-priced or demand extensive maintenance leading to exorbitant costs.

- Encourages Long-Term Growth: Building a profitable real estate portfolio means using key metrics like ROI.

It is critical to learn how to calculate ROI on real estate investments to evaluate deals effectively

Common Mistakes When Calculating ROI on Real Estate

There are a few common mistakes that many new investors make. Avoid falling into this trap while working out the real estate investment ROI. For those new to real estate, understanding how to accurately calculate ROI on real estate investments is essential.

- Ignoring Hidden Costs: ensure you are not surprised by additional or hidden costs, have he property fully assessed before purchasing.

- Overestimating Rental income: It is better to be conservative while calculating these based on the annual market. Which leads us to the next point.

- Forgetting Vacancies: There will be periods when the property is empty, plan for 1-2 months annually for this.

- Underestimating Time and Management: This is especially true with investors who take on work themselves, as the time spent is not factored in.

Please ensure while working on your ROI that you are over cautious, it is far better to be making a greater profit than losing money you had planned on.

More topics can be read on the Gamma blog

FAQ for How to Evaluate ROI on Investment in Real Estate

How to calculate ROI on an investment property?

To calculate ROI we use the formula, ROI = (Net profit / Total Investment) x 100. See our step-by-step guide for the breakdown.

How do you calculate the percent return on a real estate investment?

ROI is expressed as a percentage, which is why we multiply the total of the net profit divided by the total investment by 100.

What is the formula to calculate ROI?

ROI = (Net profit / Total Investment) x 100. See the guide for examples.

How do you calculate ROE in real estate?

ROE (Return On Equity)= Net Income / Owner’s Equity. This will measure a return based on your equity rather than your total investment. It differs from ROI as it is focused on how effectively your current equity is performing.

Although ROI is just one metric, it is a powerful one used by both new and seasoned investors. It is a foundational skill that allows the investor to compare opportunities and track performance. Learning how to calculate ROI on real estate investments is a simple process and should be used to grow wealth intelligently, as it removes the guesswork and emotion from a business deal.

It would be wise to combine ROI calculations with location risk, risk management, and due diligence to get the best deal possible. We hope that you have enjoyed learning how to calculate ROI on real estate investments and that you start calculating today before making your next real estate investment decision.