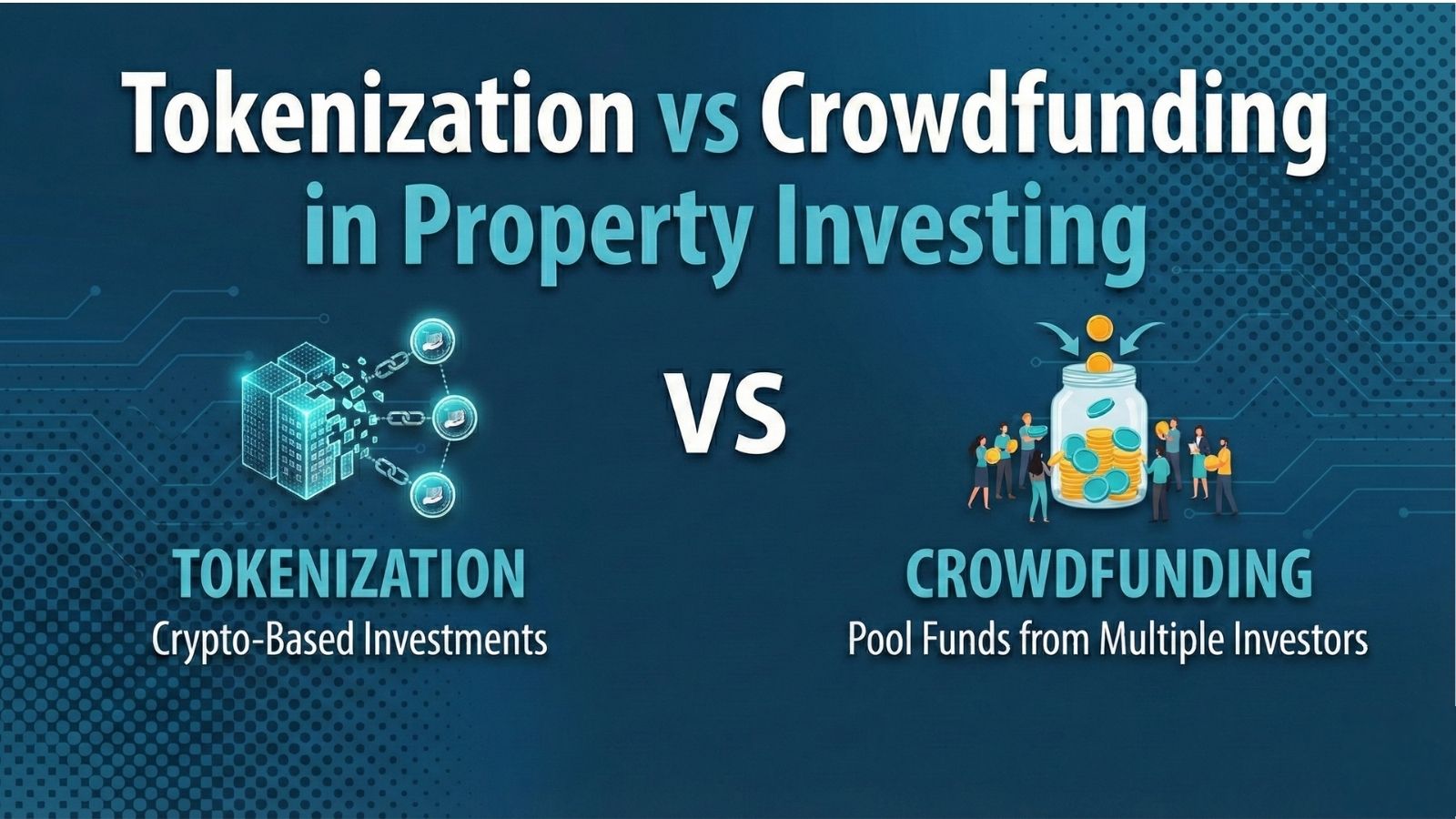

Tokenization vs Crowdfunding in Property Investing

Property investing has evolved well beyond buying buildings outright. As access to real estate becomes more digital, investors are increasingly choosing between newer models that lower entry barriers and simplify participation. Two of the most talked-about options today are tokenization and property crowdfunding.

At first, these methods may seem alike. Both let investors join real estate projects with smaller amounts of money and aim to provide income without requiring direct ownership. However, looking more closely reveals important differences between tokenization and crowdfunding, especially regarding ownership, control, transparency, and long-term flexibility.

Understanding how each model works in practice is crucial before deciding which one fits your financial goals.

More topics can be read on the Gamma blog

Tokenization vs Crowdfunding Explained Simply

The easiest way to understand tokenization vs crowdfunding is to look at how each model structures property participation.

For starters, crowdfunding pools money from multiple investors to fund a real estate project. Investors contribute capital and, in return, receive a contractual right to a share of income or profits. Ownership of the property is usually with a company or special purpose vehicle, rather than with the individual investors.

Where as tokenization takes a different approach. Properties are digitally divided into fractional units represented by tokens on a blockchain. Each token represents a defined ownership interest, recorded transparently and immutably. Investors hold tokens rather than contractual claims, and ownership is clearly defined at the asset level.

The table below outlines the main differences between tokenization vs crowdfunding in simple terms.

| Feature | Tokenization | Crowdfunding |

| Ownership model | Fractional ownership via digital tokens | Contractual participation |

| Asset linkage | Direct link to specific properties | Indirect link through project structure |

| Legal structure | Asset-backed tokens with defined rights | SPV or platform-managed agreements |

| Transparency | On-chain ownership records | Platform-reported updates |

| Investor control | Asset-specific selection | Limited influence over assets |

| Transferability | Platform or secondary market | Often restricted until exit |

| Entry barrier | Typically low | Varies by platform |

| Technology base | Blockchain infrastructure | Traditional digital platforms |

This comparison shows that while both models increase access to property investing, tokenization vs crowdfunding differ significantly in how ownership and participation are defined.

Ownership Rights and Legal Structure

Ownership is one of the most important areas where tokenization vs crowdfunding diverges.

In crowdfunding, investors usually do not own the property itself. Instead, they hold a contractual right to income or profits generated by the project. Platform terms and legal agreements govern these rights, and investors must rely on the platform to manage assets, distributions, and exits.

Tokenization provides clearer ownership definitions. Each token represents a fractional stake in a property or portfolio, with rights encoded into the token structure and supported by legal frameworks. Ownership records are transparent and verifiable, reducing ambiguity around who owns what and in what proportion.

This distinction matters when investors value clarity, traceability, and direct asset exposure. When comparing tokenization vs crowdfunding, investors should look closely at how ownership rights are documented and enforced.

Another important consideration when comparing tokenization vs crowdfunding is how ownership rights behave over time, particularly if circumstances change. In crowdfunding models, investor rights are typically fixed for the duration of the project. Capital is committed upfront, and investors must wait for the platform-defined exit, which could be a refinance, sale, or project completion. Early exits are often restricted or unavailable.

Tokenization introduces more flexibility by separating ownership from project timelines. Because ownership is fractional and digitally recorded, investors are not always locked into a single exit event. Tokens may be transferred or sold within platform rules, allowing investors to adjust their exposure without waiting for the underlying asset to be sold.

Legal clarity also differs between the two models. Crowdfunding agreements are often lengthy and complex, requiring investors to rely on legal documentation that may be difficult to interpret without professional advice. Tokenization frameworks tend to standardise ownership rights, income entitlements, and transfer conditions, making them easier to understand and verify.

When evaluating tokenization vs crowdfunding, investors should consider not only who owns the asset, but how easily that ownership can adapt to changing financial needs.

Income, Fees, and Control Differences

Both models are designed to generate income, but they do so in different ways.

Crowdfunding income is typically distributed according to predefined agreements. Returns may come from rental income, profit-sharing upon sale, or fixed-yield structures. Fees are often layered, including platform fees, management fees, and performance fees, which can reduce net returns.

Tokenization links income more directly to asset performance. Rental income is distributed proportionally to token holders based on ownership share. Because transactions and distributions can be automated through smart contracts, fee structures are often clearer and easier to track.

Control is another key distinction in tokenization vs crowdfunding. Crowdfunding investors usually have little say once funds are committed. Token holders, while still passive, often have more visibility and flexibility, particularly when it comes to transferring or exiting positions.

Income predictability is another area where tokenization vs crowdfunding differ in practice. Crowdfunding returns are often presented as projected yields, based on assumptions around occupancy, expenses, and exit timing. While these projections can be helpful, actual income may vary depending on how the project performs and how fees are applied over time.

Tokenization tends to provide more granular income visibility. Because income is tied directly to asset performance and distributed proportionally, investors can more easily track how rental income translates into returns. In some structures, distributions occur more frequently, which can appeal to investors seeking consistent passive income rather than lump-sum payouts.

Fee transparency also plays a role in long-term outcomes. Crowdfunding platforms may charge multiple fees at different stages, including acquisition, management, and exit fees. These can be difficult to assess collectively when evaluating net returns.

Tokenization platforms often present fees more clearly, particularly when smart contracts automate distributions and record transactions. This does not eliminate fees, but it does make them easier to understand and monitor.

When weighing tokenization vs crowdfunding, investors should look beyond headline returns and focus on how income is generated, distributed, and impacted by ongoing costs.

Risk and Transparency Considerations

No investment model is without risk, and both tokenization and crowdfunding come with trade-offs.

Crowdfunding risk often lies in platform dependence. Investors rely heavily on the platform’s management quality, reporting accuracy, and exit execution. Transparency varies, and updates are typically periodic rather than real-time.

Tokenization introduces technological considerations alongside traditional property risk. While blockchain infrastructure increases transparency and traceability, investors must assess platform security, regulatory compliance, and asset custody arrangements.

When evaluating tokenization vs crowdfunding, transparency is a key differentiator. Tokenization provides continuous visibility into ownership and transactions, while crowdfunding relies on trust in platform reporting. Understanding these differences helps investors align risk tolerance with structure.

Risk is often discussed in broad terms, but the nature of risk differs meaningfully between tokenization and crowdfunding. In crowdfunding, platform risk is central. Investors depend on the platform to manage assets, report performance, and execute exits. If the platform experiences operational or financial difficulties, investor outcomes may be affected regardless of asset quality.

Tokenization introduces a different risk profile. While property risk remains, technological and regulatory considerations come into play. Investors must evaluate how tokens are issued, how ownership is legally recognised, and how assets are safeguarded. Well-structured platforms address these risks through compliance frameworks, custody arrangements, and transparent reporting.

Transparency influences how risk is perceived and managed. Crowdfunding platforms typically provide updates at set intervals, which can limit visibility between reporting periods. Tokenization allows for continuous ownership verification and transaction tracking, which can reduce uncertainty and improve investor confidence.

That said, transparency does not remove risk. It simply makes risk easier to understand and assess. When comparing tokenization vs crowdfunding, investors should consider whether they prefer traditional reporting structures or real-time visibility, and how that aligns with their comfort level and investment experience.

Tokenization vs Crowdfunding on Gamma Assets

Gamma Assets offers a structured approach to property tokenization, combining digital efficiency with real-world asset backing and regulatory oversight.

Through Gamma Assets, investors access fractional ownership of real estate assets with clearly defined rights, transparent income distribution, and documented asset linkage. The platform focuses on clarity, compliance, and accessibility, addressing many of the limitations commonly associated with traditional crowdfunding models.

For investors comparing tokenization vs crowdfunding, Gamma Assets presents a model that prioritises ownership clarity, transparency, and long-term participation without requiring direct property management.

You can start investing now from the Gamma Asset Investment Platform

Tokenization vs crowdfunding is not a question of which model is better, but which model fits your expectations around ownership, transparency, and involvement. Crowdfunding simplifies access to property projects, while tokenization redefines ownership through digital infrastructure and asset-level clarity.

As property investing continues to evolve, understanding these structural differences allows investors to move beyond surface-level comparisons and make informed decisions grounded in how each model actually works.

Frequently Asked Questions

Is tokenization safer than crowdfunding?

Safety depends on regulation, platform integrity, and asset quality rather than the model itself. Crowdfunding benefits from familiarity but can lack transparency. Tokenization offers clearer ownership records, but investors must assess regulatory compliance and platform governance carefully.

Do both models offer passive income?

Yes. Both tokenization and crowdfunding are designed to provide passive income through rental yields or profit-sharing. The difference lies in how income is calculated, distributed, and reported. Tokenization often provides more direct alignment between asset performance and income received.

Which suits long-term investors better?

Long-term suitability depends on investor priorities. Crowdfunding may appeal to those comfortable with fixed project timelines. Tokenization often suits investors seeking ongoing exposure, clearer ownership, and more flexible exit options. Understanding tokenization vs crowdfunding helps investors choose a structure that supports long-term planning.